If you’re an investor, watching your portfolio grow (or shrink) with each market fluctuation likely isn’t anything new. Whether it’s day to day or year to year everything has its ups and downs, especially Bitcoin!

To properly do justice to this Bitcoin vs Real Estate debate today we’re going to go through both asset classes and quickly cover the main points, but to get the answer straight away, Bitcoin absolutely wins on virtually all fronts. There’s a good reason why many call it the most pristine capital to ever exist! That being said, some of you may still be better off with real estate.

To be clear, we’re also writing this piece on the assumption that you are truly an investor. This means that when we discuss investing in real estate, we’re not talking about your main home. We’re speaking only of extra real estate investments, such as a rental property, a second home that’s used as a store of value, commercial real estate or just something you buy to generate a positive cash flow or as a long term wealth builder.

Note: The standard disclosure obviously also applies here. None of the below should be considered to be financial advice and before you make any personal financial decisions, we recommend you speak to a financial planner that has full access to your personal finances and situation. Or maybe just ask a LLM and hopefully it won’t hallucinate and tell you to invest in a thousand monkey’s with a thousand type writers!

Contents

The Case For Bitcoin Investing

The Case For Real Estate Investing

Bitcoin Vs Real Estate, Why Not Both?

FAQ

The Case For Bitcoin Investing

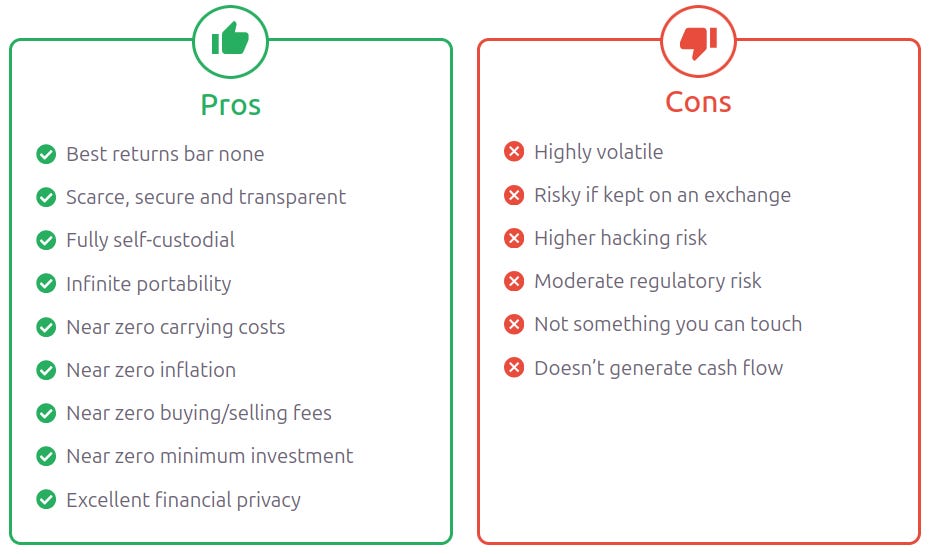

Pros Of Bitcoin

Bitcoin has been the best performing asset, period, over the past 15 years. By far. While real estate typically might get between 5-7% annual returns Bitcoin has seen years with returns over 3,900%. Even if you ignore the early days and just take the last 1, 3, 5 and 10 year time frames you’re looking at a Compound Annual Growth Rate (CAGR) of 137%, 36%, 256% and 3,174%. These investment returns are just utterly bonkers.

Of course these returns mostly stem from the the iron clad, unalterable supply limit of 21 million bitcoins. No one controls it. No one owns it. No one can stop it and everyone can always see what’s going on at every point of the system at all times. Its scarcity, security and transparency is unlike anything before and more and more people are waking up to this every day.

Bitcoin also has arguably near perfect property rights. You can hold a billion dollars of it and have full control over it at all times. No person, company or even state can take it from you or stop you from spending it. And if they try to, you can simply leave with it as it’s infinitely portable. Worst case you can remember 12 words in your mind and leave with all your wealth safe (but please don’t do this). Again, utterly bonkers.

On top of stunning property rights Bitcoin also has near zero Carrying Costs. Not many speak of this benefit, but due to having no physical form it has no ongoing storage costs, it has no physical degradation and thus, no upkeep or repair costs. It has no active management fees. There’s no property taxes, no paying a company to store it, no paying financial types to manage it.

You can buy a BitBox02 for $139 USD, pair it with Sparrow Wallet on a computer (free) and that’ll do you for a good 5-10 years. Importantly this is the same for 0.001 BTC or 1,000,000 BTC. No other asset class can compete or even come close to that!

Most importantly, Bitcoin’s inflation cost is currently 0.8% p.a. which is, yet again, utterly bonkers. This rate is on par with gold (for now) and about four times lower than the aspirational (yet rarely achieved) inflation target for most fiat currencies. To put this in perspective, here is how much purchasing power $100,000 will have after 15 years (assuming no gains) given the different inflation rates. As you can see, even just 3% takes a huge chunk out:

Bitcoin (0.8% p.a.): 100000÷1.008^15 = $88,734

USD (3% p.a.): 100000÷1.03^15 = $64,186

Buying and selling Bitcoin is also incredibly easy. It doesn’t matter if you’re selling $100 or $100 million, its liquidity is near bottomless, 24/7/365 and global. There’s no waiting, you can sell privately to a random anon in South Africa or to your friend down the road instantly. You can do this at 3AM on New Years Day as there’s no “seasonality” or business hours when trading. Buying/selling fees (trading fees) are ruthlessly low too, sometimes even free depending on what Crypto Exchange you’re using.

Along with being able to buy bitcoin any time, investors can also buy it in practically any amount. From $1 up to $100 milion there’s no “minimum investment amount” meaning even very small investors with little money can start quickly and easily. This has many benefits, mainly that it allows those that aren’t as wealthy to start accumulating hard assets for long term investment.

The financial privacy of Bitcoin is also a very under appreciated thing. Any other investment will require you to fully dox yourself, sign up to some companies platform, submit all your personal details so they can get hacked and lose it all etc etc. With bitcoin you can purchase and hold it entirely anonymously if done right.

While many think this is just something “criminals” do, privacy and having the right to selectively reveal yourself is a human right. You don’t close the bathroom door because you’re a criminal, you do it because you prefer to keep some things private. Privacy is not secrecy and bitcoin restores ones ability to keep their financial investments private if they so chose to.

Cons Of Bitcoin

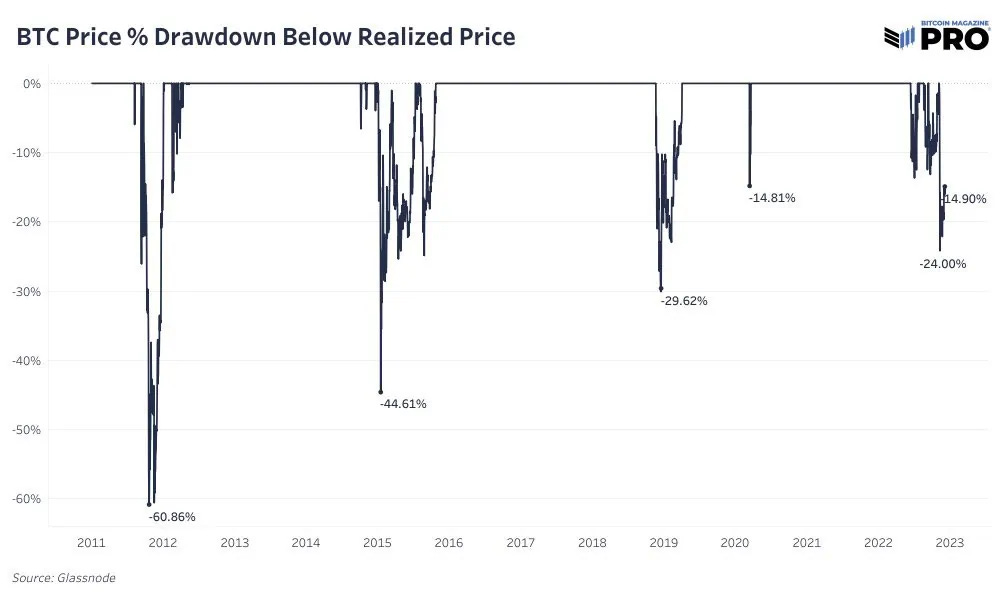

We’re not stuck in some confirmation bias bubble either, so we’re very aware that Bitcoin has a number of negative sides to it too, top of this is its incredible volatility. Even today, Bitcoin’s still a highly volatile asset that changes price every second, every day. This means if you’re not investing for a good multiple years (one to two halving cycles or 4-8 years is a good guide) then you’ll likely have a very rough, bad ride.

This high risk, high volatility, higher returns means that it’s not suitable for all investors, especially those with a very low risk tolerance. Even if your investment horizon is 10 years, you might not be able to stomach the ups and downs, resulting in you selling at the worst possible time and incurring serious losses as a result.

Many users still also allow third parties like exchanges to custody their funds for them which becomes a problem when they go bankrupt or collapse. To avoid this risk, it’s recommended to never keep your bitcoins on an exchange and to instead take full self custody. This can be a little technical for some, but is well worth it in our eyes. Driving a car is difficult to learn too, but most would agree it’s worth the effort to learn.

While hacking is a risk with virtually all assets in today’s modern world, Bitcoin is often stored by the user and not a financial institution and as such, may not be secured as well if the user isn’t very technical. This can lead to users losing their bitcoins to any number of hacking tricks that wouldn’t otherwise be possible. Using a dedicated Hardware Crypto Wallet can significantly reduce this risk as well as reviewing and being aware of the various common Bitcoin Scams that are out there.

Next up is that Bitcoin has no backup or insurance policy unlike regular cash deposits at a bank. You can certainly take out insurance on your bitcoin, but it’s not something many investors do and is quite new. As such, it’s quite costly and not widely available.

As Bitcoin is still very new, regulations are still evolving as time goes on. As Bitcoin grows and draws more attention upon itself, regulation is expect to increase. However since the most recent US election the tides on crypto seem to have shifted significantly. More large companies, pension funds and even a government or two are investing publicly in it which is all making the waters a lot warmer.

Having a physical, tangible asset that you can hold in your hands also isn’t really a thing with Bitcoin. Some investors prefer assets like gold, art, watches or real estate precisely because they can touch and feel it. The digital currency has been given some quasi physical forms such as Ballet Coins, but ultimately the bitcoin are still stored on the Blockchain, not the physical item. This can be troubling for some investors as they cannot mentally accept that all their wealth is in something purely digital that they can’t ever really see or touch.

Finally there’s the fact that although the Bitcoin network, protocol and cryptography that secures it have been battle tested for 15+ years, it’s still possible that someone may find a design flaw. The world is a big place and the future of technology isn’t certain in this new digital age, but we believe this is incredibly unlikely to happen.

The Case For Real Estate Investing

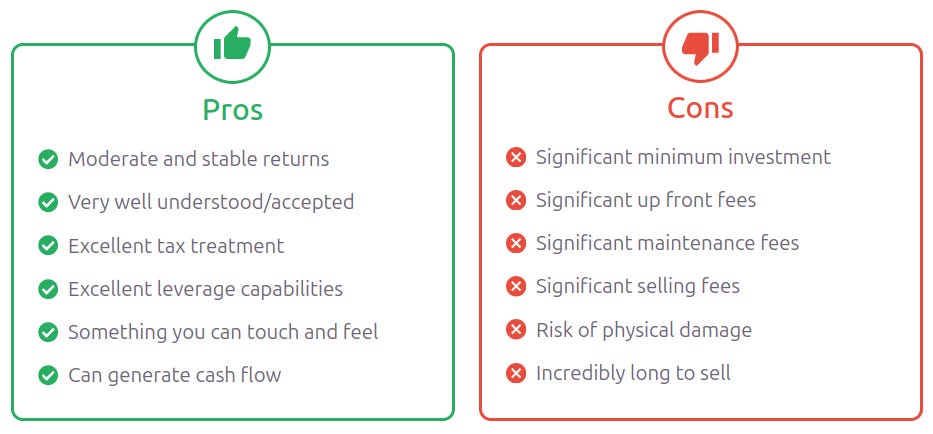

Pros Of Traditional Real Estate

Real estate in the USA has done quite well, returning an average annual rate of about 5.64% p.a. over the last decade. Looking back 1, 3 and 5 years you’d have made a 9.4%, 3.96% and 8.44% return respectively. Solid, historically standard results for sure, plus they don’t even include the potential cash flow that can be gained if it’s a rental property.

Beyond stable returns, one of the biggest benefits of the real estate market has to be that it’s generally well understood and common place. While you obviously wouldn’t go in blind and not do research, most people don’t have to look up “What Is Real Estate?” when buying it like they do with Bitcoin. Real estate is common and heavily integrated into most societies meaning there’s social support for it (no one thinks you’re stupid if you buy it), tax support and even monetary support in the form of easily accessible loans.

Loans (or leverage) are another huge bonus for real estate. Most banks would laugh you out the front door if you approached them for a $300,000 loan to buy $250,000 worth of Bitcoin (unless you’re Saylor), but this is an everyday occurrence for those wanting to buy a house.

A big part of property is also the huge tax benefits. From America to Austria there’s bound to be some sort of tax benefit you can get your hands on when you buy an investment property. These benefits can make a huge difference in returns and in some cases even mean completely tax free returns if you play your cards just right.

It’s also a solid, tangible asset. While you can’t “live in it” in the context that we’re discussing, as we’re only comparing investment real estate not your own principal house, it’s still something you can point to and know it’s yours. You can renovate it, walk through it, touch it and so on. For many investors this is a big deal and helps create trust when dealing with large amounts of money.

And finally real estate is more or less, a very stable investment. While other asset classes will gyrate all over the place on the back of company X going under or war Y breaking out, real estate mostly returns a steady price increase over the years. This gives stability and can be crucial for people that are wanting to use it for a reliable income in their later years.

Cons Of Traditional Real Estate

On the negative side real estate is a significant up front cost for most. While the bank might happily give you a $250,000 loan, they’re not going to do so without the $50,000 down payment and you can’t buy a house for $5. That being said, you can purchase shares in a Real Estate Investment Trust (REIT) for much smaller amounts, typically starting at around a few thousand dollars to start with.

The returns mentioned above are obviously “overall” and could be much lower or higher depending on where your house is located. Market conditions in various areas is a huge factor when it comes to both property value and rental returns, meaning that if you just so happen to pick the wrong suburb, your returns could be toast.

Fees, fees, fees! Buying fees, stamp duties, interest costs on the loan, loan opening fees, conveyance fees, building and pest inspection costs, ongoing maintenance fees, property taxes, selling costs, the fees both up front and ongoing are seemingly endless which all significantly eat into your profits.

That maintenance is not just a cost either, it’s a significant effort and time suck, especially if there’s renovations required. This could involve dealing with trades people, councils, body corporate and more again costing you dearly when it comes to your overall profit not to mention sanity.

Speaking of maintenance and repairs, a big down side to real estate investing is that your house can be physically damaged by storms, fires, trees or many other natural disasters over its life. Yes you can insure it (even more fees!) but sometimes you can’t or the amount they charge is in the tens of thousands per year so people don’t.

Once you’re done with the asset and want to dispose of it you’re looking at one of the longest and most involved selling processes of any asset. Stocks, bonds or Bitcoin can all essentially be sold on the day (or within a week) at the press of a button. Real estate investing however typically requires paying thousands and spending weeks just to prepare the house and put it up for sale. You’ll then wait weeks to months for the right buyer and once sold, settlement will then take another few months!

Bitcoin Vs Real Estate, Why Not Both?

As you can see, which one “wins” deeply depends on many variables such as what your investment time frame is, how much your minimum investment amount is, whether you are OK with digital assets, are OK with higher risk assets and so much more.

Bitcoin is a high-risk, high-reward investment with many fantastic upsides such as a huge annualized return, low maintenance and no big upfront investment required.. Real estate investment is lower risk, lower reward, but also much stabler and you get something physical on top of amazing tax savings and leverage capabilities. While real estate provides a steady income in the form of rental income, the total return will likely still lag Bitcoin with its higher volatility.

Neither are perfect and both have their places, which is why as an investor you may even end up owning both as a way to hedge each of them. Instead of getting an expensive property, perhaps you’ll preference a smaller one together with some bitcoin exposure. How much you allocate is, as always, entirely up to you! Hopefully the above analysis has helped you decide.

FAQ

Is Bitcoin Better Investment Than Real Estate?

It depends. Both have their pros and cons and which one is the better investment will greatly depend on what your financial situation and preferences are. You should always see a financial planner that has full access to your finances and preferences to help you decide which one is best for your unique situation.

Is It Legal To Buy A House With Bitcoin?

Yes. In most countries where Bitcoin is not banned buying property with Bitcoin is perfectly legal as long as the seller is comfortable with accepting it and its documented properly.

Is Bitcoin Considered Real Estate?

Bitcoin is a digital currency and as such, is not considered a real estate asset. That being said, due to its limited, fixed supply of 21 million, many see each bitcoin as representing a “block” in cyberspace that you can own. This is simply a mental model though.

Want to get serious about safely and privately using Bitcoin? You need to subscribe now.

Benefits Include:

Read by the top experts, writers, investors and companies in Bitcoin

Learn more about Bitcoin than 99% of people in just one hour a month

Secure your Bitcoin investments and ensure they stay safe from hackers

Know what risks your investments are exposed to and how to fix them

Keep pace with Bitcoins rapid growth and what opportunities it enables

Get insights into how Bitcoin can help your business or work save thousands

Step-by-step guides for all aspects of Bitcoin (wallets, buying and more)

How to do all of these things and maintain your privacy!

NO MORE LOST FUNDS!